Operating profit margin looks at profits after charging non-production overheads. It means that any change in ROCE can be explained by either a change in Operating profit margin, or a change in asset turnover, or both. For example, if you are told that a business has an Operating profit margin of 5% and an asset turnover of 2, then its ROCE will be 10% (5% x 2). This relationship can be useful in exam calculations. They are considered at the same time because: The ROCE and Operating profit margin ratios are often considered in conjunction with the asset turnover ratio. Retailers generally have high asset turnovers accompanied by low margins. Commonly a high asset turnover is accompanied with a low return on sales and vice versa. Generally, the higher the better, but in later studies you will consider the problems caused by overtrading (operating a business at a level not sustainable by its capital employed). This measures the ability of the organisation to generate sales from its capital employed. Poor performance is often explained by prices being too low or costs (cost of sales or overheads) being too high. Again, in simple terms, the higher the better. Operating profit margin (sometimes known as net profit margin) looks at operating profit earned as a percentage of revenue.

It should be compared with returns on offer to investors from alternative investments of a similar risk. Generally, the higher the ROCE or ROE figure, the better it is for investors. By similar logic, if we wished to calculate return on ordinary shareholders funds, we would use profit after interest and tax divided by total equity.Ī return on capital is necessary to reward investors for the risks they are taking by investing in the company.

Capital employed can be calculated as (non-current liabilities + total equity) or (total assets - current liabilities). It is therefore compared with the long-term debt and equity capital invested in the business. This represents the profit available to pay interest to debt investors and dividends to shareholders. Profit before interest and tax (PBIT), can also be given as Operating profit. What is important is to compare like with like. Candidates are sometimes confused about which profit and capital figures to use. Return on capital employed (sometimes known as return on investment or ROI) measures the return that is being earned on the capital invested in the business. Return on capital employed (ROCE)/Return on equity (ROE) Gross margin= (Gross profit ÷ Revenue) x100% Operating profit margin = (PBIT ÷ Revenue) x 100%Īsset turnover = Revenue ÷ Capital employed Return on equity (ROE) = (Profit after interest and tax ÷ total equity) x 100% Return on capital employed (ROCE) = (Profit before interest and tax (PBIT) ÷ Capital employed) x 100% Profit is necessary to give investors the return they require, and to provide funds for reinvestment in the business. Profitability ratios, as their name suggests, measure the organisation’s ability to deliver profits. Ratios can be categorised into four headings: profitability, liquidity, activity (efficiency) and gearing. This article will focus on measures of financial performance and will detail the skills and knowledge expected from candidates in the FMA/MA exam.įMA/MA candidates are expected to be able to calculate key accounting ratios, to know what they measure, and to explain what particular values mean. The FMA/MA syllabus introduces candidates to performance measurement and requires candidates to be able to 'Discuss and calculate measures of financial performance and non-financial measures'. It will also be regularly used by successful candidates in their future careers. The ability to analyse financial statements using ratios and percentages to assess the performance of organisations is a skill that will be tested in many of ACCA’s exams.

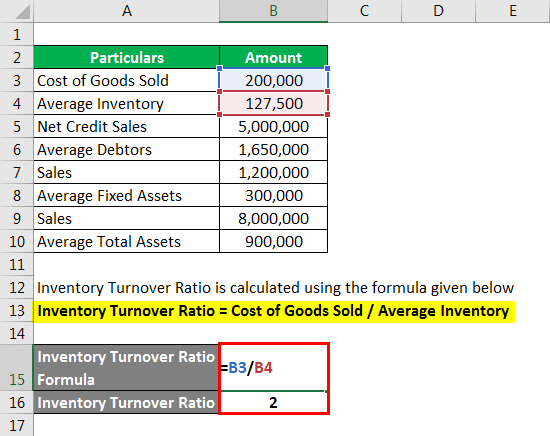

ACCOUNTING INVENTORY TURNOVER RATIO PROFESSIONAL

An introduction to professional insights.Virtual classroom support for learning partners.Becoming an ACCA Approved Learning Partner.

0 kommentar(er)

0 kommentar(er)